As a trader, the best objective is to maximize results on assets while decreasing deficits. Achieving this requires traders to experience a comprehensive idea of the financial markets and sound investment techniques. A great technique that many dealers ignore is understanding the art of take profit techniques. In this post, we’ll take a good look at what take profit is, the many take profit methods, and ways to use them to optimize your earnings.

What exactly is Take Profit?

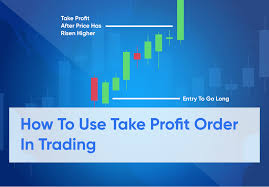

futures trading review is surely an instruction that is certainly set by way of a trader that directs their agent to close a trade each time a predetermined selling price stage has become arrived at. It is a trader’s method of sealing in earnings. Each time a trader packages a take profit stage, they may be essentially environment the price level from which they’d love to exit a buy and sell and take their profits. Take profit is really a danger managing strategy which is valuable in volatile marketplaces where costs can go up and down swiftly.

Various Take Profit Tactics:

You will find various methods of utilizing take profit techniques, such as acceptable importance, specialized evaluation, and simple examination. One way to use technological analysis is always to established take profit degrees at vital support and opposition amounts. This can be done by examining the current market price trend and identifying vital degrees of support and opposition. By way of example, in case a trader goes into a industry at $100 and determines a opposition stage at $110, they could establish a take profit stage at $109 in order to avoid the danger of the purchase price dropping beneath the level of resistance levels.

Yet another strategy is to apply a trailing end-reduction get as a take profit levels. Trailing end-decrease purchases assistance to lock in earnings by changing the quit damage level as price ranges relocate the trader’s prefer. Which means that when the value movements from the trader’s favour, the stop loss is altered to go by the purchase price to ensure when the value drops, the buy and sell is going to be shut down in the quit-reduction levels.

Employing Essential Assessment to create Take Revenue:

Essential analysis is an additional method that forex traders are able to use to put take profit ranges. This kind of assessment involves the analysis of a company’s financial and financial standing. Traders may use basic assessment to ascertain a company’s fair importance and set up take profit ranges based on that value. By way of example, when a trader feels a company is undervalued, they may set up a take profit levels that may be higher than the present selling price.

Simply speaking:

As being a trader, perfecting take profit methods is essential in perfecting returns. Dealers should carefully assess the current market trend, identify help and resistance degrees, and employ technical and basic analysis to put take profit amounts. You must ensure that you have a good knowledge of the current market as well as the different take profit methods accessible prior to applying them. By understanding these methods, you’ll not simply have the capacity to improve your earnings and also reduce your losses.